BBI Analysis of the 84.51° Shopper Insights for the 2022 Holiday Season

.avif)

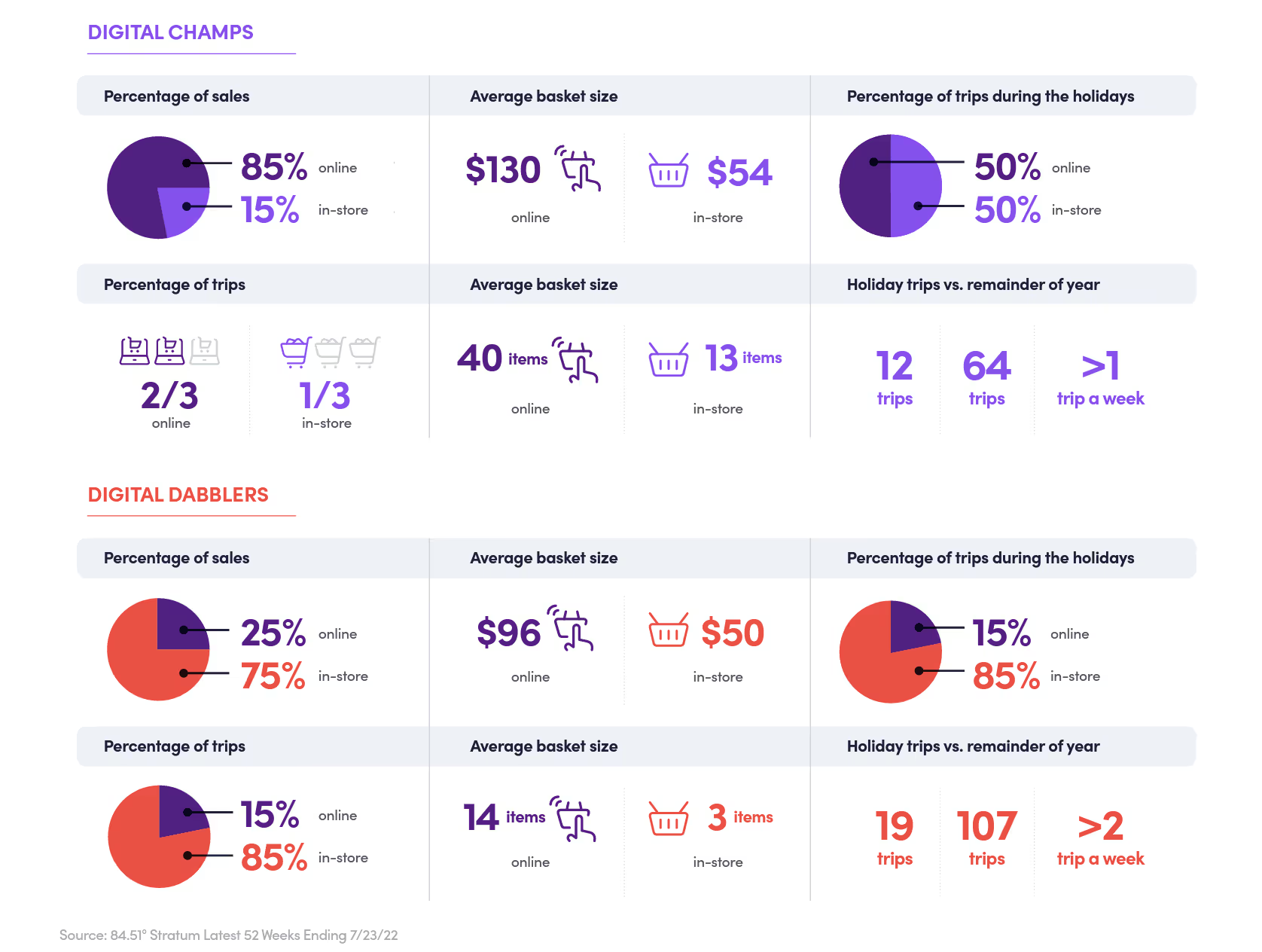

Although supply chain and inflation levels affect the industry, consumers look forward to bringing back some holiday traditions and celebrating in 2022. Last year, the hybrid shopper emerged as an established segment of consumers who move comfortably between in-person and online shopping. This broad spectrum of consumers ranges from low e-commerce-loyal “Digital Dabblers” to “Digital Champs” who are highly dedicated to shopping online.

Eight Key Insights for Holiday 2022

84.51° is a retail data science, insights, and media company that identified eight shopper insights to win the in-store and digital holiday season.

Insight 1 - Shoppers are willing to spend more on premium items during the holidays.

Brands with holiday ties can build loyalty and enhance existing relationships by offering relevant discounts to help those holiday dollars go further. In contrast, brands of non-holiday-specific items (think detergent or paper towels) can leverage this propensity to spend with targeted digital coupons. By grabbing their attention on the digital platforms they frequent and intercepting them with brand messaging and offers as they shop online, brands can own related digital shelf opportunities. From a grocery standpoint, we can expect households to spend more this holiday but pick up fewer units. It’s even more critical for brands to make it into customers’ baskets by pulling creative levers to help shoppers save money. Brands can prioritize strategies that drive basket building, including meal solutions, bundles, and cross-promotions.

Insight 2 -Due to the rise in inflation, shoppers generally become less brand loyal and more likely to brand switch.

Consumers are more comfortable putting unfamiliar items in their carts. This increasing acceptance of “what’s available” should prompt brands to use advertising to drive brand affinity by articulating differentiation and value. It also creates couponing opportunities for brands to either thank existing shoppers for their brand loyalty or incentivize trial and drive repeat purchases for households trying them for the first time.

Insight 3 - Shoppers are still particular about their main holiday course brand.

The holidays are fueled by nostalgia and heritage, and when shoppers sense those factors may be in danger, they take action. With supply chain shortages in mind, brands should get a jump on the holiday season and drive brand affinity for holiday main course products by offering early or “stock-up” deals for shoppers afraid their favorite items might run out.

Insight 4 - Customers anticipate larger gatherings for the holidays as life returns to normal post-COVID.

Brands should offer recipes, meal ideas, or celebratory solutions based on their products’ fit — as well as share messaging around food waste and how to use leftovers. Party hosts will also be buying items in bulk to accommodate their guests, so brands should consider couponing and offer strategies for numbers and depth of discount.

Insight 5 - Digital touchpoints influence the majority of shoppers.

Digitally influenced shoppers appreciate the ease and convenience of digital coupons. And shoppers utilize digital coupons more during the holidays compared to the rest of the year. The total sales coming from digital coupons increased for all shoppers by 2% during the holidays versus the remainder of the year and by more than 180% compared to the year prior.

Insight 6 - Shoppers are looking forward to making side dishes from scratch.

While shoppers prefer to buy some side dishes in-store (hint: skip the homemade cranberry sauce), they still prefer to offer their friends and families a gift from their heart and kitchen.

Insight 7 - Customers plan to purchase more gifts and décor during the holidays

Shoppers are most likely to shop for gifts and decor in-store and online, broadening omnichannel opportunities for brands.

Insight 8 - More shoppers will rely on gift cards for holiday giving.

Gift cards fit all sizes, interests, and tastes, so it’s no surprise they are a gift-giving staple.

While the 2022 holiday shopping season seems to be another unusual one, with the continued growth of the omnichannel shopper and inflation still on the rise, every CPG brand — regardless of size, popularity, or commodity — has an opportunity to make an impact this holiday season.